The taxpayer funds the majority of county government via the property tax, or ad valorem tax, which is the largest revenue source for Texas counties. Tax Code Section 5.091 requires the comptroller's office to prepare a list that includes the total tax rate imposed by each taxing unit in Texas, as reported to the comptroller by each appraisal district. The tax rates included … [Read more...] about 2021 County Property Tax Report

Revenue Related

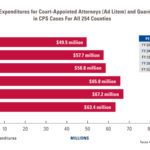

The Cost of County Government

Results of the 2020 Unfunded Mandates Survey

A Collaborative Report by the: Texas Association of Counties, County Judges and Commissioners Association of Texas, Texas Conference of Urban Counties, Texas Association of County Auditors and County Treasurers Association of Texas Editor’s Note: This survey was created to help explain the cost of unfunded and underfunded mandates on property tax payers. The … [Read more...] about The Cost of County Government

Educating the Public on Your Bond Election

When it comes to financing, public education can be an arduous task. In some cases, the initial step is to set aside some stifling assumptions: If we can’t pay cash, it’s not worth doing. The voters will never go for it. If I obligate the county to this debt, some of the constituents will not see fit to re-elect me. Perhaps voters deserve more credit. It’s safe … [Read more...] about Educating the Public on Your Bond Election

Fine and Fee Collection

Challenging Times Call for Examination of Revenue Sources

Throughout 2019, local governments dependent upon the property tax carefully followed the progress of Senate Bill 2, passed by the 86th Texas Legislature and signed by the governor last June. Property taxes are the primary funding source for Texas counties, and S.B. 2 reduces this funding potential. “Maximizing additional revenue sources will be essential,” said Jim … [Read more...] about Fine and Fee Collection

Public Finance Options

Public Finance: Exploring County Options Mission accomplished…at least the seemingly toughest leg of the mission. On May 14, 2011, Smith County voters passed the issuance of $35 million in tax bonds for the Smith County Jail and criminal justice facilities expansion/remodeling project with a vote of 3,644 for and 2,136 against. Four previous bond … [Read more...] about Public Finance Options