TxDOT Adopts Grant Rules, Sets Quick Filing Deadline Applications Due Feb. 7-14

The Texas Department of Transportation (TxDOT) adopted the final rules on the County Transportation Infrastructure Fund Grant Program on Nov. 21. TxDOT also announced a narrow window, Feb. 7-14, for counties to submit an application to apply for grant funds. While a request to extend the application period has been submitted to TxDOT, as of press time the current deadline remains Feb. 14. This leaves counties little time to adhere to the requirements established by Senate Bill 1747 and the adopted rules.

The Texas Department of Transportation (TxDOT) adopted the final rules on the County Transportation Infrastructure Fund Grant Program on Nov. 21. TxDOT also announced a narrow window, Feb. 7-14, for counties to submit an application to apply for grant funds. While a request to extend the application period has been submitted to TxDOT, as of press time the current deadline remains Feb. 14. This leaves counties little time to adhere to the requirements established by Senate Bill 1747 and the adopted rules.

The State of Texas earmarked some $225 million to a transportation infrastructure fund via the 83rd Texas Legislature’s S.B. 1747.

Oil- and gas-affected counties may be eligible for grant money from this fund for projects defined by the statute as “the planning for, construction of, reconstruction of, or maintenance of transportation infrastructure, including roads, bridges, and culverts, intended to alleviate degradation caused by the exploration, development, or production of oil or gas.”

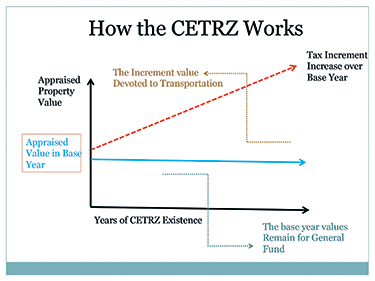

The new legislation amends Chapter 256 of the Transportation Code and creates a Tax Infrastructure Fund (TIF) for County Energy Transportation Reinvestment Zones (CETRZ). The TIF is a dedicated fund in the state treasury outside of the state’s general fund.

TxDOT sent a notice of “Request for Application” to every county judge in the state. Applications are required to be submitted online at http://www.txdot.gov/government/funding/county-fund.html.

The County Judges and Commissioners Association of Texas and the Texas Association of Counties joined forces to create the following comprehensive presentation on everything you need to know to participate in this program and meet the filing deadline.

__________________________

CETRZ Guide

A County must establish a designated County Energy Transportation Reinvestment Zone (CETRZ) under section 222.1071 of Texas Transportation Code to be eligible for a grant, pursuant to Chapter 256 of Texas Transportation Code, for one or more transportation infrastructure projects (TIPs) from the Texas Department of Transportation (DOT). Each CETRZ shall contain at least one project, but not all projects funded by a grant must be located within a CETRZ. A county may establish more than one CETRZ.

Practical suggestion: Before establishing a CETRZ, evaluate the county roads and determine those most likely to benefit from a grant project; provide this information to the CETRZ advisory board.

Each CETRZ must be composed of a contiguous geographic area.

Practical suggestion: The Appraisal District may provide assistance in preparing the description of the CETRZ area, i.e. provide a list of property within the zone by tax parcel number or plat map.

The following steps are required to establish a CETRZ:

7 days prior to Commissioners Court’s public hearing on creation of CETRZ publish notice of public hearing in general circulation newspaper in County.

30 days prior to designating CETRZ, Commissioners Court holds public hearing on creation of CETRZ and its benefits to county and property in proposed CETRZ, where interested persons may speak for or against proposed CETRZ.

Commissioners Court, after proper notice, has a hearing and enters order:

First determining that an area is affected by oil & gas activities & would benefit from funding under Ch. 256;

Then designating “contiguous” area within County’s jurisdiction to be CETRZ to promote one or more TIPs;

Sufficiently describing boundaries of CETRZ to reasonably identify territory in CETRZ;

Stating CETRZ is effective immediately upon adoption of order;

Stating base year is either year of adoption of order or some year in future; and

Establishing ad valorem tax increment account for CETRZ or providing for establishment of joint ad valorem tax increment account, if applicable.

If two or more counties are designating CETRZ for TIPs, finding that:

TIPs benefit property & residents in CETRZ;

Creation of CETRZ serves public purpose of County; and

Detailing which County is responsible for each TIP.

Dedicating all of “captured appraised value of real property” in CETRZ to TIPs;

Creating & stating terms and duties of Advisory Board for CETRZ for establishment, administration and expenditures of CETRZ, whose members County Judge appoints & Commissioners Court approves, and are comprised of:

Up to 3 oil & gas company representatives performing activities in county and being local tax payers; and

2 public members.

Determining tax increment for CETRZ (which is the same as a Transportation Reinvestment Zone):

the amount of County ad valorem taxes levied & collected for that year on the “captured appraised value of real property” taxable by the county and located in an CETRZ;

the “captured appraised value of real property” taxable by a county for a year is the total appraised value of all real property taxable by the county and located in a CETRZ for that year less the tax increment base of the county; and

the “tax increment base of a county” is the total appraised value of all real property taxable by the county and located in a CETRZ for the year in which the zone was designated.

Stating CETRZ terminates on Dec. 31 of 10th year after designation of CETRZ, unless Commissioners Court enters order extending CETRZ;

Stating Commissioners Court’s extension, if any, of CETRZ shall be no more than 5 years; and

Stating it shall comply with all applicable laws under Chapter 222 of Texas Transportation Code.

Practical reminder: While the revenue in the tax increment fund is excluded from the calculation of the effective tax rate and the rollback rate, creating a CETRZ will commit all of the increased tax revenue from property in the CETRZ to transportation infrastructure projects (road and bridge budget) for ten years.

County may jointly administer CETRZ with another contiguous county’s CETRZ.

Joint CETRZs have a single Joint Advisory Board for the Joint CETRZ.

Advisory Board members are not paid or reimbursed for expenses.

Application Requirements

Road condition report under section 251.018 of Texas Transportation Code, including the new statutory requirement stating the primary cause, if reasonably ascertained, of degradation of road, culvert, or bridge;

Practical suggestion: Prepare a revised report containing this new information (likely damage from overweight oil and gas truck traffic).

Copy of Order Establishing CETRZ; TxDOT may waive requirement for copy of Order until Grant is awarded.

Plan containing:

List of Transportation Infrastructure Projects (TIPs) to be funded by grant;

Description of scope of TIPs to be funded by grant;

Providing for matching funds (20% of grant or 10% if TxDOT determines County is economically disadvantaged);

Meeting any other requirements of TxDOT.

County’s second or subsequent grant application must:

Provide the Road Condition Report for the previous year;

Certify all previous grants spent in accordance with Plan; and

Provide accounting of how previous grants spent, including administrative costs.

Practical suggestion: While awaiting application forms and projected amount of grant eligibility for your county, begin review of county roads for possible projects and potential boundaries of CETRZ. Do not expend county funds until final grant award is received.

Calendar for 2014 Grant Funds

WORKING BACKWARDS FROM 2/7/2014 DEADLINE, MUST PUBLISH NOTICE IN NEWSPAPER NO LESS THAN 37 DAYS EARLIER. This calendar takes into account weekends and is a suggestion only. You must determine deadline for Newspaper Notice, and deliver to Newspaper in sufficient time to allow publication before deadline. These dates can be accelerated within time remaining.

Monday, 12/09/2013-Approve Posting for Public Hearing, determine if assistance is required.

Monday, 12/30/2013-Latest Date for Notice of Public Hearing

Monday, 1/6/2014-Latest Date for Public Hearing

Wednesday, 2/5/2014-Latest Date for Order Adopting CETRZ

Friday, 2/7/2014-Deadline for filing TxDOT Application

Agenda for Adoption of Order

AGENDA NOTICE

TAKE UP FOR CONSIDERATION AND POSSIBLE ACTION: After due notice and a public hearing conducted on January 6, 2014, the Commissioners Court will consider and take possible action regarding the creation of one or more County Energy Transportation Reinvestment Zone(s), pursuant to §222. 1071 of the Texas Transportation Code, as well as the appointment of an Advisory Board to serve in an advisory capacity to the Commissioners Court regarding such County Energy Transportation Reinvestment Zone(s), pursuant to Section 222.1072, Texas Transportation Code.

____________________ County Clerk

CETRZ Statute Requires Report

See Key Concept and Sample Road Report, pages 10-11.

Existing Law: The road report “shall be entered in the minutes of the Commissioners Court to be considered in improving public roads and determining the amount of taxes imposed for public roads.”

In addition, “the report shall be submitted, together with each contract made by the court since its last report for any work on any road, to the grand jury at the first term of the district court occurring after the report is made to the Commissioners Court.”

In the 83rd Legislative Session, the Legislature provided for County Energy Transportation Reinvestment Zones. This legislation imposes a new section, §251.018, which requires a road report for all counties, to include in all previously required reports a statement of the “primary cause of any road, culvert or bridge degradation if reasonably ascertained.” This provision is tied to an effort to identify and track the costs to the state and county for road damages attributable to heavy truck traffic in the oil and gas sector.

Order Adopting CETRZ

IN THE COMMISSIONERS COURT OF [County Name] COUNTY ORDER AUTHORIZING THE CREATION OF A COUNTY ENERGY TRANSPORTATION REINVESTMENT ZONE KNOWN AS [County Name] COUNTY ENERGY TRANSPORTATION REINVESTMENT ZONE NO. 1-[Area Name] ESTABLISHING A BASE YEAR FOR AD VALOREM TAX VALUES, CREATING AND STATING THE TERMS AND DUTIES OF THE [County Name] COUNTY ENERGY TRANSPORTATION REINVESTMENT ZONE ADVISORY BOARD, AND ESTABLISHING AN AD VALOREM INCREMENT ACCOUNT

BE IT REMEMBERED, that the Commissioners Court of [County Name] County, Texas, prior to this date, has provided public notice by publication in a newspaper of general circulation in the county to be printed not less than seven (7) days prior to a public hearing, and after conducting said public hearing as required by §222.1071 of the Texas Transportation Code on the 9th day of December, 2013, the Commissioners Court of [County Name] County, Texas does hereby:

Make a formal determination that [County Name] County has been severely affected by the development of new oil and gas activity within the county generally, and more particularly, adversely affected by the increased heavy truck traffic on county maintained roads, and

Further determine that [County Name] County would benefit from the availability of funds provided by the State of Texas pursuant to the provisions of Chapter 256 of the Texas Transportation Code, and

The area described more fully herein is unproductive and underdeveloped and the creation of a County Energy Transportation Reinvestment Zone would promote the public safety, facilitate the improvement, development or redevelopment of the property affected and enhance the County’s ability to sponsor transportation projects within the said zone.

Finally, the creation of a County Energy Transportation Reinvestment Zone and the establishment of an ad valorem tax increment account will assist the county in addressing the fiscal needs of the county, while permitting enhanced stability in the county budgeting process.

IT IS THEREFORE ORDERED, ADJUDGED AND DECREED that the Commissioners Court of [County Name] County, Texas, hereby establishes and creates a County Energy Transportation Reinvestment Zone as authorized by Chapter 222 of the Texas Transportation Code, such Zone to be titled as [County Name] County Energy Transportation Zone No. 1-[Area Name] and operated in compliance with said Chapter, and the Commissioners Court further designates the contiguous territory identified in Exhibit A, attached hereto and incorporated herein by this reference, as the zone in which the captured appraised value of real property located within the zone shall be used to determine the tax increment funds to be devoted to transportation infrastructure projects within the limits of said zone.

IT IS FURTHER ORDERED, ADJUDGED AND DECREED that the base year for purposes of determining the subsequent tax increment for the [County Name] County Energy Transportation Reinvestment Zone No. 1-[Area Name] shall be the year of 2013, being the year of adoption of this Order, on the 9th day of December, 2013

In this regard, it is the FURTHER ORDER OF THIS COMMISSIONERS COURT, that an Advisory Board for the [County Name] County Energy Transportation Reinvestment Zone No. 1-[Area Name], is hereby created, whose members shall serve for two years terms, and whose successors may be appointed by the Commissioners Court as their terms expire, or as vacancies may occur from time to time. The Advisory Board for the [County Name] County Energy Transportation Reinvestment Zone No. 1-[Area Name], shall not be entitled to receive compensation for service on the board, nor entitled to reimbursement for expenses incurred in performing services as a member of the Advisory Board.

The Advisory Board shall meet not less than quarterly, in compliance with the Texas Open Meetings Act, and shall perform such tasks, or functions as provided by law and as the Commissioners Court may from time to time require of the Advisory Board. The Advisory Board shall review all project plans for the zone created by this Order, and shall provide comment and recommendations to the Commissioners Court regarding the development of all plans and expenditure of funds from the Tax Increment Account established to benefit Transportation Infrastructure Projects within the zone created by this Order. Such recommendations shall be duly considered by the Commissioners Court, but are not binding upon the Commissioners Court.

Members of the Advisory Board are:

__________________________ Member

__________________________ Member

__________________________ Member

__________________________ Member

__________________________ Member

IT IS FURTHER ORDERED, ADJUDGED AND DECREED that the County Treasurer shall establish a suitable interest bearing account, to be known as the [County Name] County Energy Transportation Reinvestment Zone No. 1-[Area Name] Tax Increment Account, and that such funds as may be accrued, pursuant to the provisions of §222.1701, Texas Transportation Code, shall be deposited annually into said account, together with such other and sundry funds as may be allocated to the said tax increment account by the Commissioners Court of [County Name] County, Texas. Such funds may only be expended in compliance with Section 222.1071 (i) and (j), of the Texas Transportation Code, and only by separate Order of the Commissioners Court.

The [County Name] County Energy Transportation Reinvestment Zone No. 1-[Area Name] shall remain in full force and effect for the initial term of ten years from the date of formation, and shall terminate on December 31 of the tenth (10th) year after designation of the zone, unless terminated earlier in conformity with law.

Read and Adopted this ___ day of _______________, 2014 by a vote of _____ayes and _______nays.

___________________________

County Judge

___________________________

Commissioner, Precinct 1

___________________________

Commissioner, Precinct 2

___________________________

Commissioner, Precinct 3

___________________________

Commissioner, Precinct 4

ATTEST:

___________________________

County Clerk