By Julie Anderson, Editor

Smith County wasn’t bluffing.

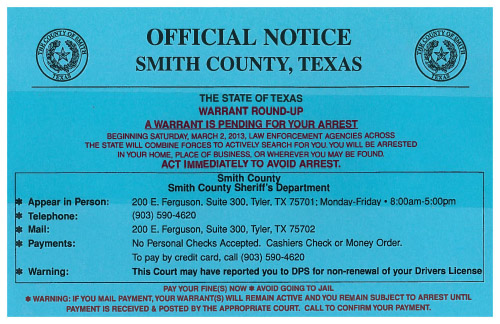

In fact, the message was unmistakable: Pay your fine, or we will find you and arrest you “in your home, at your business, or wherever you may be found.”

Smith County joined forces with more than 300 other jurisdictions across Texas to participate in the largest joint warrant round-up in the state. Anyone who owed a court fine or fee in one of the participating districts had two weeks, ending March 2, 2013, to pay before officers were dispatched to find and arrest them.

Smith County joined forces with more than 300 other jurisdictions across Texas to participate in the largest joint warrant round-up in the state. Anyone who owed a court fine or fee in one of the participating districts had two weeks, ending March 2, 2013, to pay before officers were dispatched to find and arrest them.

Some 400-plus debtors responded to the strongly worded promise, closing out their outstanding cases by paying up.

“We were able to recapture $80,000 that belongs to the citizens of this county,” said Smith County Judge Joel Baker. “That is $80,000 that can be put back into services for the citizens.

“We are very proud of the results from this year’s warrant round-up, and we will continue to pursue those individuals who still owe the county long after the round-up is over,” Baker asserted.

Mandated Collection Programs

Back in 2005, the 79th Texas Legislature addressed county collections via the passage of Senate Bill 1863 requiring counties of 50,000 or more to develop and implement a program to collect court costs, fees and fines imposed in criminal cases to include district, county and justice courts, unless granted a waiver.

Believing that a local option program would be more efficient, county representatives requested that the 82nd Legislature repeal the mandatory provisions, as indicated by House Bill 2949, said Jim Allison, general counsel for the County Judges and Commissioners Association of Texas. This bill passed, was signed by the governor, and was to become effective on Sept. 1, 2011. However, during the ensuing special session, conferees nullified the actions of the regular session and resurrected the mandated program.

The required provisions are:

conform with a model developed by the Office of Court Administration designed to improve in-house collections through application of best practices; and

improve collection of balances more than 60 days past due, which may be implemented by entering into a contract with a private attorney or public or private vendor. According to state law, a 30 percent fee can be assessed on a fine or fee, which is the firm’s payment for collection.

The Smith County Collections Department manages fines that are assessed by the county’s judges, said Smith County Judicial Compliance Supervisor Sheryl Keel.

“Defendants are closely monitored for compliance, and action is taken promptly for non-compliance,” Keel related. Actions include telephone contact, letter notification, alerting the specific court for non-renewal of driver’s licenses, and possible issuance of a warrant within a specified timeframe. The county also uses an outside law firm for the collection of past due cases.

The keys to an effective collections program are strict payment terms and efficient use of available tools to improve and maximize collections of fines and fees, such as the county’s software program that monitors payment plans and the use of an automated voice dialing system, Keel listed.

Warrant Round-Up: A Team Effort

The warrant round-up is another effective tool used by Smith County, one that recently produced what Keel touted as “amazing results.” In fact, once the round-up notices were mailed and received, Keel’s phone began “ringing off the hook.”

“We made great efforts to contact everyone who owes a court fee in Smith County, and we encouraged them to pay their fines before they experienced the embarrassment of being picked up by law enforcement officers at their work or home,” Keel declared.

This large-scale collections campaign required the combined efforts of the justice of the peace courts; the offices of pre-trial release, county clerk, county sheriff, and county constables; and the county’s outside collection firm.

“It takes a lot of effort and a great deal of cooperation between offices to have a successful warrant round-up,” explained Smith County Commissioner JoAnn Hampton. “It takes a lot of organization to stay on top and know exactly who owes the county, and it takes a great deal of time and determination to follow through and find those people.”

The county also tapped into the local media outlets to clearly communicate that “you will be arrested at home, your place of business, or wherever we can find you,” Keel stressed. Very few arrests were made, as those confronted agreed to pay their debts before being taken into custody.

Even though the round-up is over, Smith County’s warrant division is working remaining cases alongside the county constables.

“My goal is to make it known that Smith County has zero tolerance,” Keel emphasized. “If your court costs and fines go unpaid, you will be held accountable.”

Outsourcing Collections

When the Texas Department of Public Safety (DPS) did away with the Warrant Data Bank, Freestone County needed another avenue to collect delinquent fines and fees, said Freestone County Pct. 2 Justice of the Peace Debra Hamilton.

The county opted to outsource delinquent collections with McCreary, Veselka, Bragg & Allen, P.C.

“Our county has resolved more than 45 percent of our delinquent fines in our justice courts,” Hamilton conveyed. The law firm locates the defendant with delinquent fines, and his or her case is either paid, cancelled or recalled.

“This also releases our county officers from delinquent fines to pursue other county issues,” Hamilton stated.

Wichita County chose to outsource as an effort “to maximize our collection efforts,” explained Wichita County Pct. 1-2 Justice of the Peace Michael Little.

“We felt that even though we had our own collections department, this would enhance our ability to collect funds that were lawfully due,” Little continued.

The county contracted with Perdue Brandon Fielder Collins & Mott‚ LLP.

“We have exceeded all expectations regarding the amount of delinquent fines we were able to collect,” Little reported. “This close working relationship ensures that our collection program meets state requirements and maximizes the collection of delinquent fines and fees owed to Wichita County.”

Jim Wells County does not have the technology software to access the most recent contact information of delinquent account holders, said Jim Wells County Pct. 5 Justice of the Peace Luz Paiz. The county hired Linebarger Goggan Blair & Sampson, LLP, to tap into this technology.

“It was taking an excessive amount of the court’s time trying to collect delinquent fines, and the results were low,” Paiz indicated. “The county selected a firm that specializes in this area, which has increased revenue for Jim Wells County and has freed the time of the court staff to attend to other necessary duties.”

Once the DPS Warrant Data Bank was shut down, Wharton County “needed a way to collect the fines that were just sitting there,” said Wharton County Pct. 2 Justice of the Peace Cindy Kubicek.

The county decided to outsource the task and hired Graves Humphries Stahl, Ltd. (GHS) to pursue delinquent fine and fee collections.

“It saves our county a great deal of work and expense,” Kubicek maintained. “It also brings in money the county would never see since most of the people who had not paid were not from this area but passing through,” she continued, “and we didn’t really have access to them.”

Because state law allows these outside firms to assess a 30 percent fee on top of the fine, the county is not out any additional expense.