By early March, it was clear that 2020 would be a challenging year for county budgets. Revenue caps and radical procedural changes imposed by the legislature require new procedures and a steep learning curve. The catastrophic decline in oil industry activity and production will force a massive shift in the local tax burden in many counties. Then, the COVID-19 epidemic struck, essentially halting all economic and governmental activity for two months. Sales tax revenues have plummeted. Property appraisals, linked to Jan. 1 values, have been delayed and created widespread controversy. Unexpected demands for county health services and state prisoners in the jail have capsized the current budget and created uncertainty in the need for future expenditures. The specter of another wave of Coronavirus and its effects on revenues and expenditures clouds the horizon for next year. With no commitment for additional state or federal assistance, counties must craft a budget and tax rate that can survive these tests.

With the posting of the new Truth-in-Taxation forms and procedures on the website of the Texas Comptroller of Public Accounts, counties can begin the process of reconciling the budget needs with the tax rate limitations. Counties are strenuously attempting to hold expenditures to the absolute minimum to reduce the burden on their taxpayers. However, the reduction in other revenues (sales taxes, fines and fees) may compel a greater reliance on property taxes. Working with the Truth-in-Taxation forms, including the new exclusions for indigent defense, hospital costs, and the “de minimis” rate for small counties, will establish the exact limitation on the property tax rate unless a November referendum is held.

Most counties will adopt a budget that can be funded within the new S.B. 2 tax rate caps of either 3.5 percent or the $500,000 “de minimis” rate. However, because Gov. Greg Abbott has declared a disaster in the entire state, counties may utilize the special taxing unit voter-approval rate of 8 percent. See Section 26.04(c-1), Tax Code. This will allow an increase of up to 8 percent without a mandatory referendum.

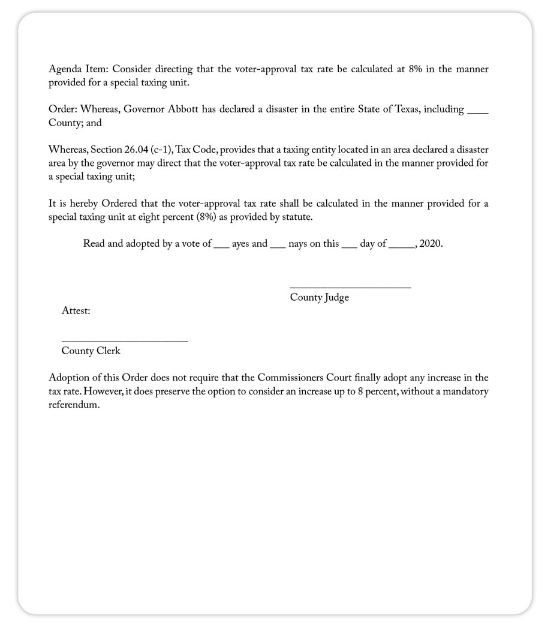

To have the option of considering a voter-approval rate of 8 percent for maintenance and operations, the Commissioners Court must act before Aug. 1 to instruct that the Truth-in-Taxation forms reflect the special taxing entity voter-approval rate of 8 percent. While no special notice or hearing is required, the Commissioners Court must post and instruct this calculation. Below is a sample agenda item and order:

By Jim Allison

CJCAT General Counsel