The taxpayer funds the majority of county government via the property tax, or ad valorem tax, which is the largest revenue source for Texas counties.

The 84th Texas Legislature passed Senate Bill 1760, which states that the Texas Comptroller is required to publish on its website a statewide list of tax rates that includes the total tax rate reported by each taxing unit in Texas, other than a school district, for the year preceding the year in which the list is prepared. The tax rates are to be published no later than Dec. 31 of each year.

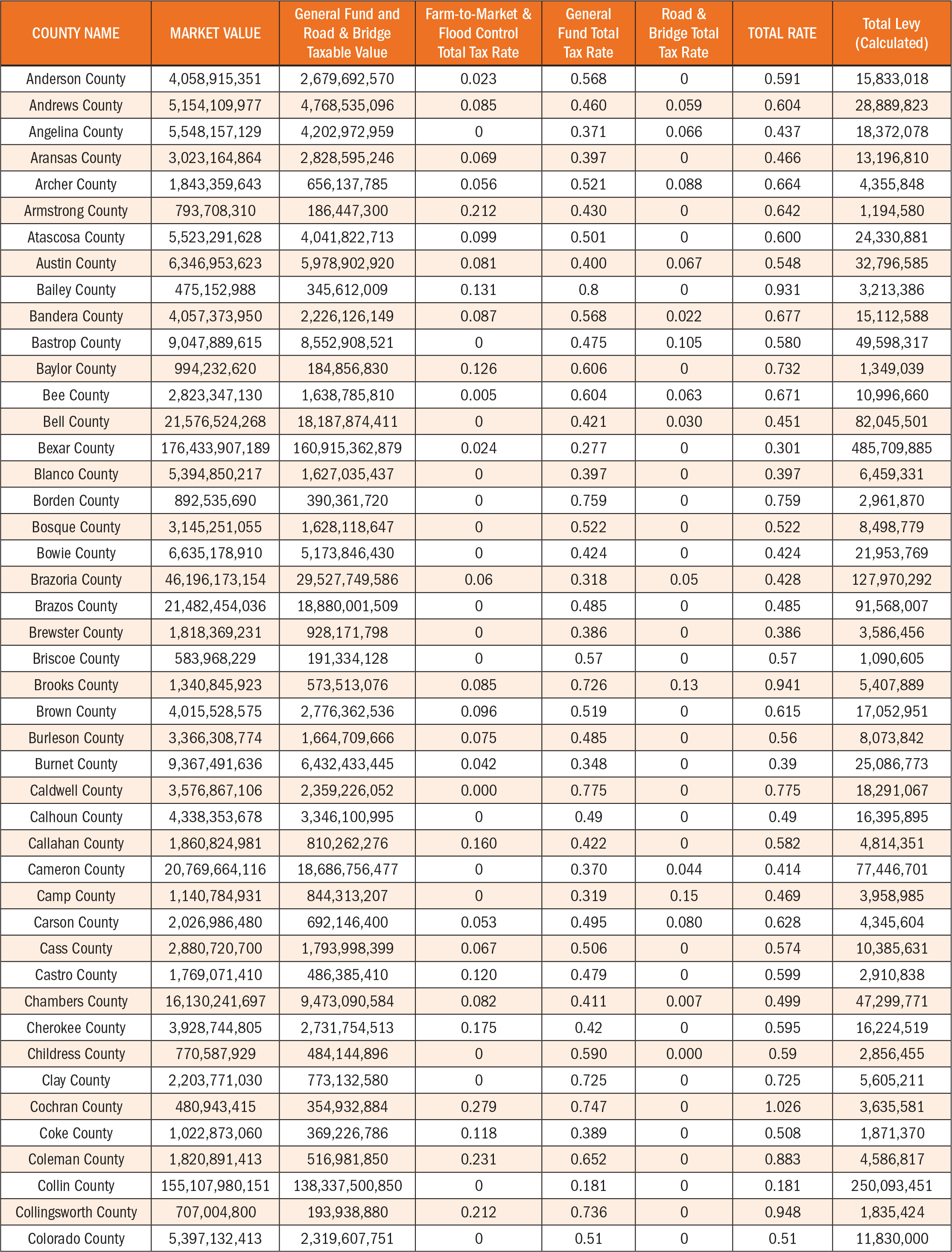

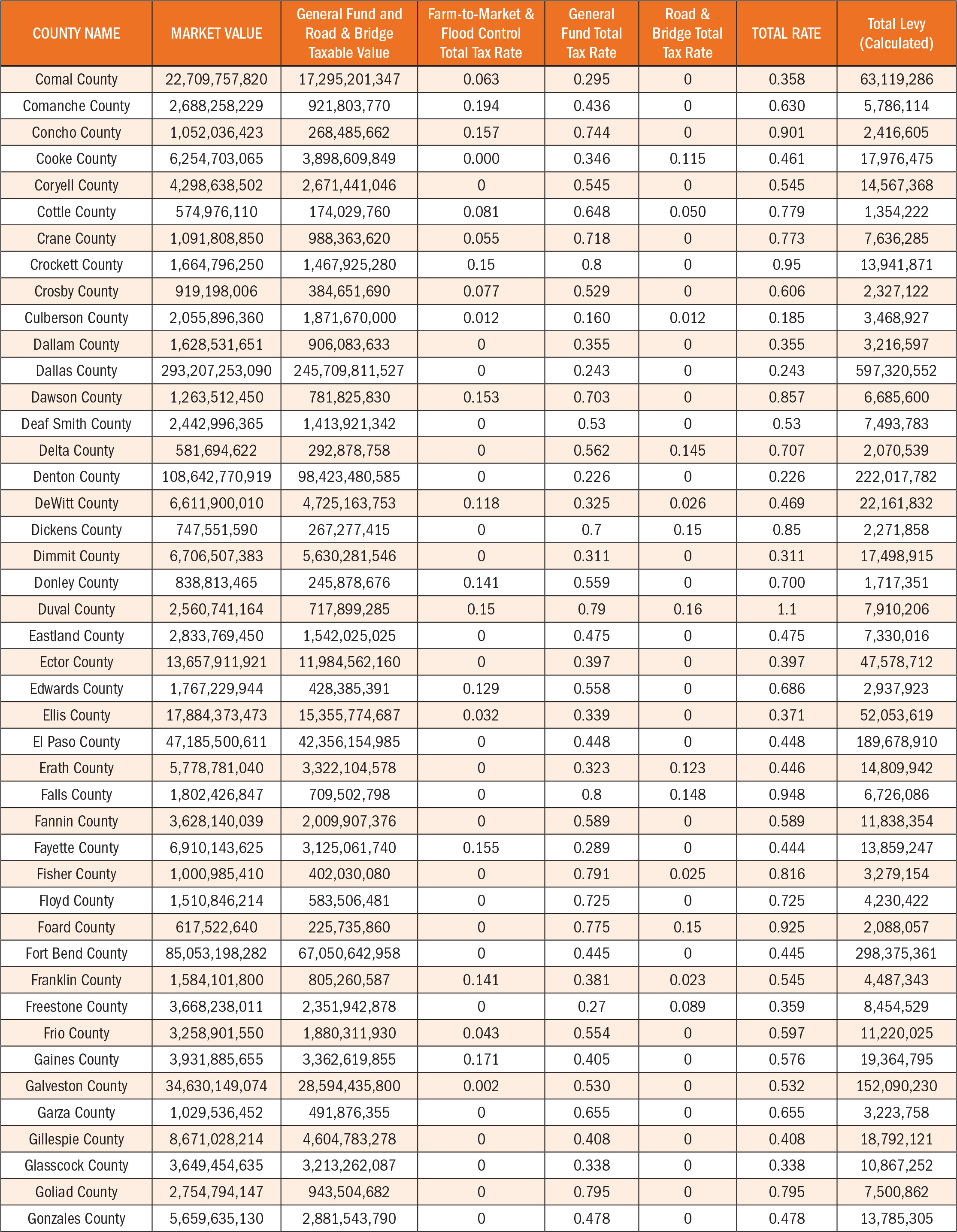

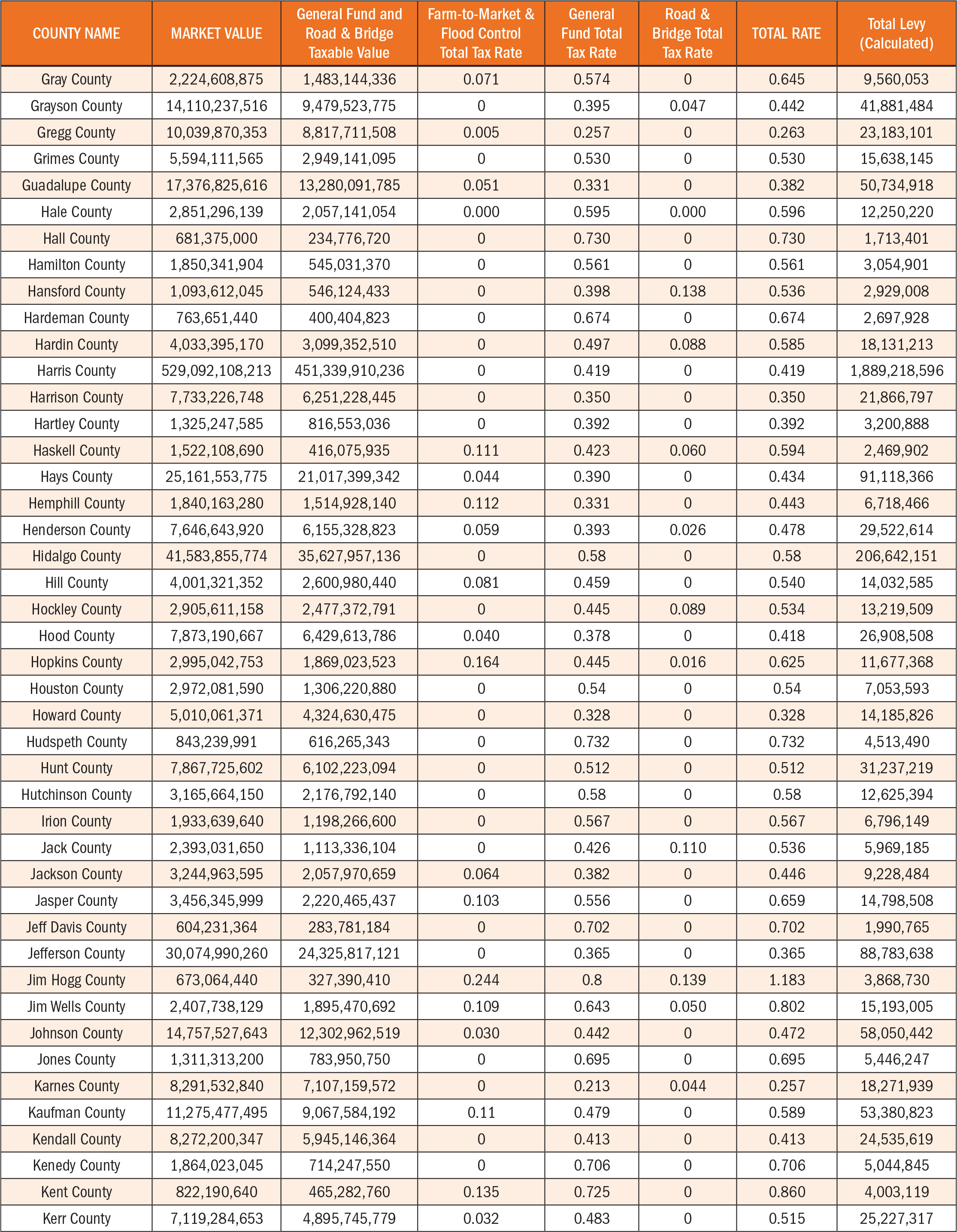

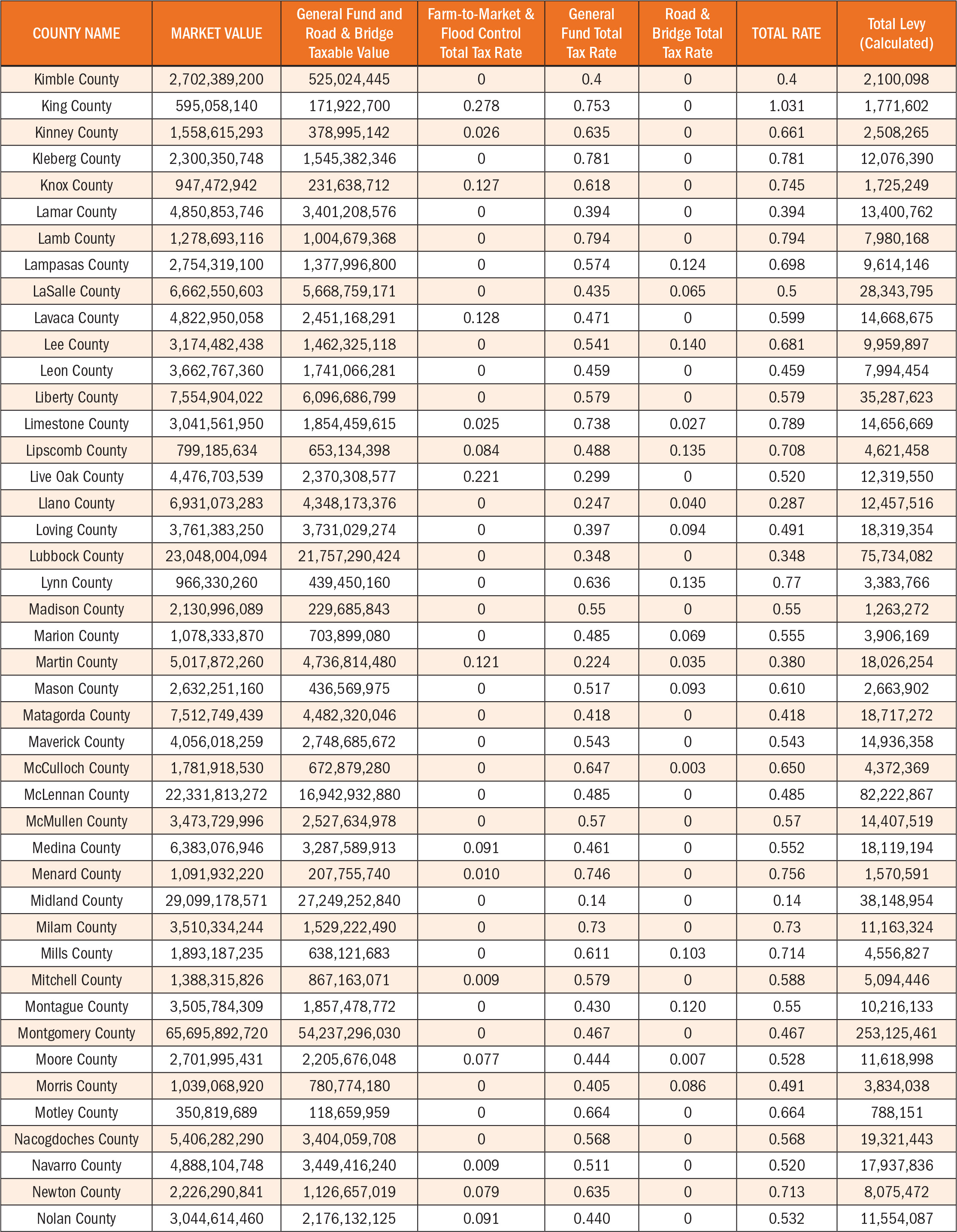

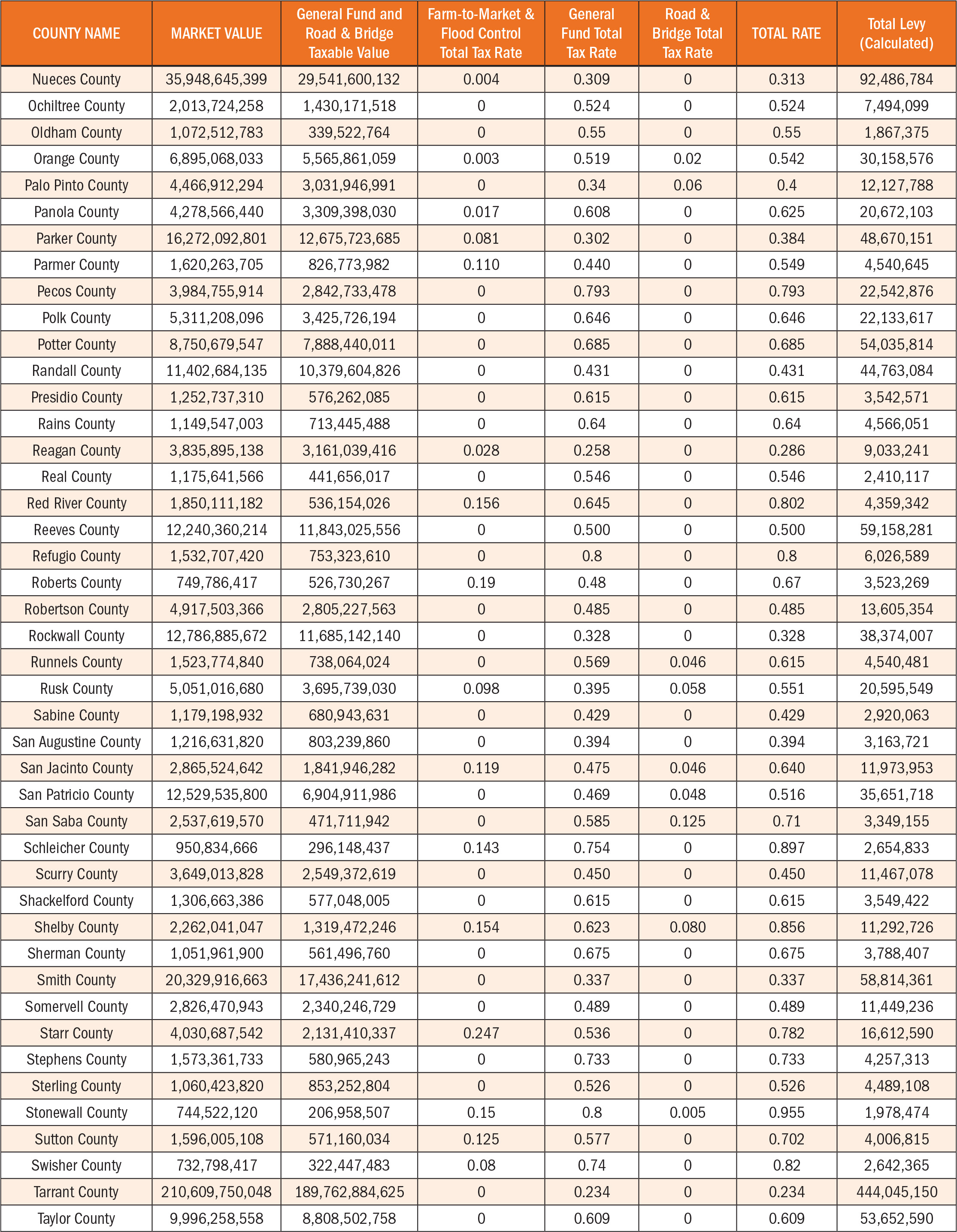

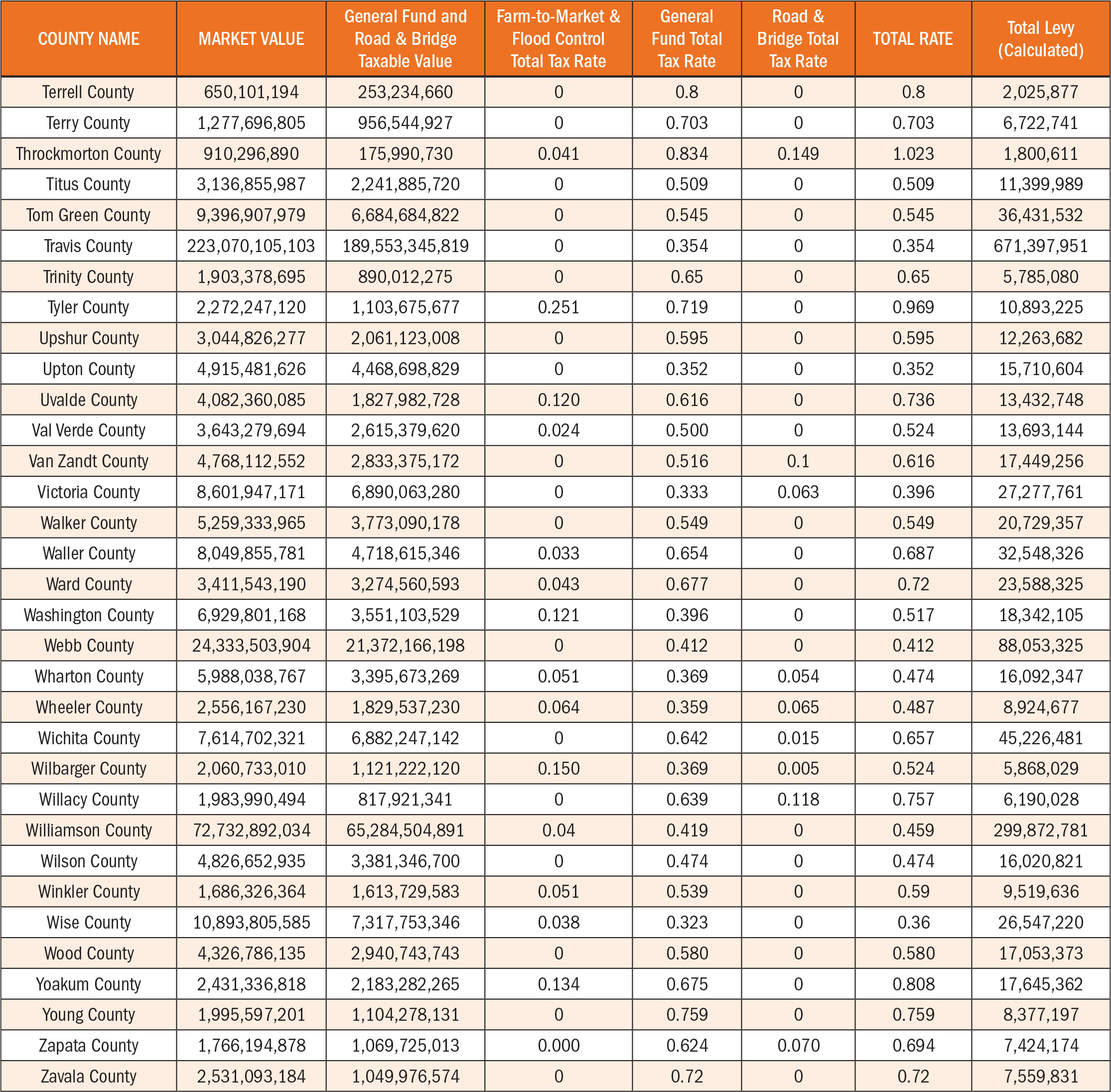

The Office of the Texas Comptroller released the self-reported 2018 county property tax data in late August, available in full at https://comptroller.texas.gov/taxes/property-tax/rates/index.php, with the following categories listed for each county:

- Market Value

- Farm-to-Market and Flood Control Taxable Value

- General Fund and Road & Bridge Taxable Value

- Effective Tax Rate

- Rollback Tax Rate

- Farm-to-Market & Flood Control M&O Tax Rate

- Farm-to-Market & Flood Control I&S Tax Rate

- Farm-to-Market & Flood Control Total Tax Rate

- General Fund M&O Tax Rate

- General Fund I&S Tax Rate

- General Fund Total Tax Rate

- Road & Bridge M&O Tax Rate

- Road & Bridge I&S Tax Rate

- Road & Bridge Total Tax Rate

- Total Tax Rate

- Total Levy (calculated)

The following report includes a partial listing of self-reported county data.