Early Coordination, Continual Communication Keys to Navigating New Process

“You’re going to have to start earlier and inform other departments. This is not a Commissioners Court problem. This is a county problem.” CJCAT General Counsel Jim Allison

The new requirements resulting from Senate Bill 2 passed by the 86th Texas Legislature have compressed budget-related deadlines and will require careful coordination and systematic communication between the Commissioners Court, all county departments, and the public, said Jim Allison, general counsel of the County Judges and Commissioners Association of Texas. Counties develop their budget using the guidelines spelled out under Chapter 111 of the Local Government Code. The process for proposing the tax rate is explained in Chapter 140 of the Local Government Code and Chapter 26 of the Tax Code. Most of the provisions of S.B. 2 were effective Jan. 1, 2020.

Determining Your County’s Voter-Approval Rate

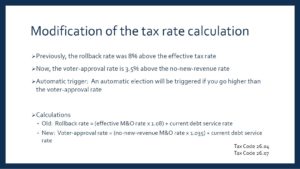

S.B. 2 renames the rollback tax rate as the voter-approval tax rate and renames the effective tax rate as the no-new-revenue tax rate.

The first step in launching the budget process will be to determine your county’s voter-approval rate, Allison listed. Under the former law, the rollback tax rate provided the taxing unit with about the same amount of tax revenue it spent the previous year for day-to-day maintenance and operations (M&O), plus an extra 8 percent revenue increase for those operations, in addition to sufficient funds to pay debts in the coming year. If the county set a rate that resulted in more than the 8 percent revenue increase, voters had the option to petition for a rollback election. Under the new law, the standard voter-approval tax rate has been reduced from 8 percent to 3.5 percent, and mandatory elections will be required to exceed the 3.5 percent rate. However, there are several exceptions that can increase the rate.

- A disaster declaration will reinstate the 8 percent cap for at least two years after the disaster declaration.

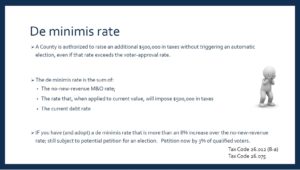

- A county may increase its tax by $500,000 without an automatic election for this “de minimis” increase but can force a petition election if it exceeds an 8 percent increase.

- Adjustments are allowed to the standard 3.5 percent cap for increased state inmate costs, indigent health care costs, county hospital costs (8 percent maximum), indigent defense costs (5 percent maximum), and unused increment rate (after 2020).

Slides courtesy of Randy H. Riggs, CPA, PCC, McLennan County Tax Assessor-Collector

Slides courtesy of Randy H. Riggs, CPA, PCC, McLennan County Tax Assessor-Collector

The Office of the Texas Comptroller is developing a truth-in-taxation form that will be used to calculate the voter-approval rate for the coming year; as of press time, the form was not yet available.

Is My County Maximizing All Revenue Sources?

Property taxes are the primary funding source for Texas counties, and S.B. 2 reduces this funding potential.

“Maximizing additional revenue sources will be essential,” Allison emphasized. Counties should immediately begin an examination of all of their income categories. Specific suggestions include:

- Review fine and fee collections, and determine if improvements can be made.

- Study optional fees to determine potential increases.

- Negotiate payments in lieu of taxes (PILOT) in your tax abatement agreements.

- Urge the full prosecution of bond forfeitures.

- Fully implement the Optional Motor Vehicle Registration Fee.

Begin Budgeting Early: What Are My County’s Unavoidable Costs?

Commissioners Courts must still fund essential services and absorb any increased costs of state-mandated services, Allison underscored. Commissioners Courts need to be tabulating these costs including employee salaries, health care, fuel and materials, supplies, equipment (such as voting machines), equipment maintenance, etc.

Once the voter-approval rate has been determined and costs have been estimated, budget planners will be able to determine whether or not any potential revenue remains and communicate with county departments accordingly.

Explain Budget Limitations to Other County Departments and Evaluate Options

Most county departments have wish lists. However, revenue caps likely mean reality checks for many counties and the creation of dual lists: 1) items that can be afforded under the voter-approval rate, and 2) items that can be afforded under a voter-approved tax rate that exceeds the voter-approval rate. These items can be labeled in the budget at adoption or a subsequent budget amendment. This informs the departments and the public that these items will be eliminated or reduced if the tax rate is not approved.

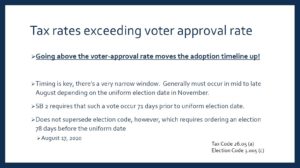

If the county determines that essential services cannot be maintained by a budget under the voter-approval rate, it may be necessary to call for a November election; at this point, a statutory timeline comes into effect, Allison highlighted. S.B. 2 requires that a vote occur 71 days prior to the uniform election date. However, this does not supersede the election code, which requires ordering an election 78 days before the uniform date, meaning Aug. 17, 2020, (Tax Code 26.05 (a), Election Code 3.005 (c).

“Since there is no AG Opinion or court decision resolving this statutory conflict, we recommend compliance with the earlier date required by the Election Code,” Allison explained. “This will require earlier budget and tax rate hearings,” he reiterated.

Educate the Public

County funds cannot be used to campaign for the approval of a higher tax rate, Allison reminded officials. However, county officials can educate the public on the county budget.

In the past, Commissioners Courts and other officials have shared the need for increased revenue using general terms: law enforcement, equipment maintenance, etc. However, Allison urged Judges and Commissioners to call upon officials countywide to explain the specific budget items that would only be fundable via a higher rate.

“We need everybody on deck,” Allison declared. “We need every elected official out there.” For example, the sheriff can offer details on what the higher rate would fund in the sheriff’s department, i.e. additional patrol cars or more deputies.

“We’re going to have to go to the voters with a specific list,” Allison continued. This is especially important because the language on the actual ballot will not list the items that will be funded by the higher rate; voters need to know before heading to the polls.

During the recent V.G. Young School for County Commissioners Courts, Allison pointed to the Scurry County rollback election process in late 2019/early 2020 as an example of how to educate the voters.

Should Our County Look at Financing Debt?

The Tax Code continues to exclude the debt service rate from the calculation of the voter-approval rate, Allison reminded officials. Although funding capital items such as equipment and vehicles through debt issuance will mean additional cost and higher taxes, it is an option when revenue caps and referendums are not feasible.

“The ramifications of S.B. 2 may seem overwhelming,” Allison observed. However, strategizing early will make the process a little more manageable.

As additional information becomes available, Allison will share sample orders and budget amendments on the county listservs and in County Progress Magazine.