Tax Years 2014 and 2015

The following is an excerpt from the Biennial Property Tax Report published in December 2016. The full report is available at https://www.comptroller.texas.gov/taxes/property-tax/docs/96-1728.pdf.

The Tax Code directs the Office of the Texas Comptroller to publish a biennial report of the appraised and taxable values of properties by category and the tax rates of counties, cities and school districts for a two-year period. This report provides the governor, the lieutenant governor and each member of the Legislature a single point of reference for appraised values, taxable values and tax levies and rates of Texas taxing units.

The Tax Code authorizes the comptroller’s office to require each appraisal district engaged in appraising property for taxation to submit an annual survey on the administration and operation of the appraisal district. The comptroller’s office provides data on the operations of appraisal districts, such as budgets, chief appraiser salaries, board makeup, appraisal review board activities and other data relevant to the property tax process. The comptroller’s office gathers this data through the Electronic Appraisal Roll Submissions from appraisal districts and the Comptroller’s Appraisal District Operations Survey.

The comptroller’s office provides data for this report in downloadable electronic spreadsheets that include the total market and taxable values and tax rates for all school districts, counties and cities at https://www.comptroller.texas.gov/taxes/property-tax/rates/index.php.

Overview

Texas cities, counties, school districts and other taxing units rely on property tax to fund their operations. In addition to property tax, taxing units may also impose, levy and collect other taxes and fees as authorized by law.

Local property tax remains the largest tax assessed in Texas. Property taxes levied by taxing units statewide exceeded $49 billion in 2014 and $52 billion in 2015 (Exhibit 1).

While local property taxes account for almost half of all tax revenue in the state, the state does not appraise property for property tax purposes, set property tax rates or collect property taxes.

The next largest tax revenue source in Texas is the sales tax, which is imposed by both the state government and local taxing units. As demonstrated in Exhibit 1, local taxing units collect 55 percent of all taxes in the state, while state government collects 45 percent.

Local Property Tax

The Texas Constitution sets out five basic rules for property taxes.

The first requirement is that taxation must be equal and uniform. Local officials must base property taxes on values determined by appraisal districts.

Second, property must be assessed at no more than fair cash market value – the price for which it would sell when both buyer and seller seek the best price and neither is under pressure to buy or sell. Except as provided by the Texas Constitution, all real and tangible personal property shall be taxed in proportion to its value, which shall be ascertained as provided by law. The Texas Constitution provides certain exceptions to this rule, such as the use of productivity values for agricultural and timber land.

Third, each property in a county must have a single appraised value. This means that the various taxing units that collect property taxes cannot assign different values to the same property – all must use the same value.

Fourth, all property is taxable unless federal or state law exempts it from the tax. These exemptions may exclude all or part of a property’s value from taxation.

Finally, property owners have a right to reasonable notice of increases in the appraised value of their property.

Taxing units can assess and collect property taxes for two primary uses. First, they can collect a maintenance and operations (M&O) tax that is used primarily to pay for the day-to-day functions of the government. An interest and sinking (I&S) tax is collected to pay bonds, including interest, to finance capital projects such as buildings, facilities or other infrastructure. While I&S property taxes are not the only way for taxing units to pay for infrastructure, it is one of the primary tools available for this purpose.

Tax Rates and Levies by County

In addition to the required tax rates for counties, cities and school districts, this report includes data on property tax rates and levies for special purpose districts.

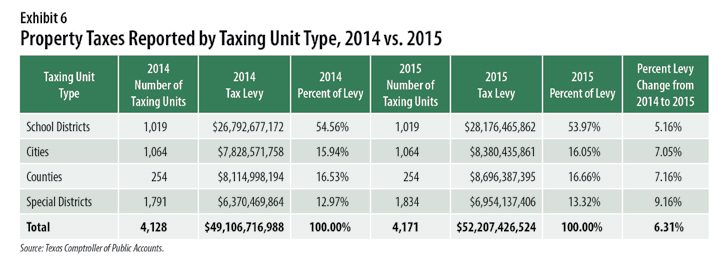

Local Property Tax Levies

In tax year 2015, Texas’ cities, counties, school districts and special purpose districts levied more than $52 billion in property taxes – 6.31 percent more than in 2014. Unlike other taxing units, which can also collect sales taxes and fees, school districts’ only source of tax revenue is property tax. In 2015, the state’s 1,019 school districts levied over $28 billion in property taxes, or almost 54 percent of all property taxes levied by cities, counties, school districts and special purpose districts in the state (Exhibit 6).

Counties collected the second-largest share of property tax in 2015 – almost $8.7 billion, an increase of over 7 percent from the 2014 levy. Cities followed closely behind

with a property tax levy of almost $8.4 billion, which is 7.05 percent more than in 2014.

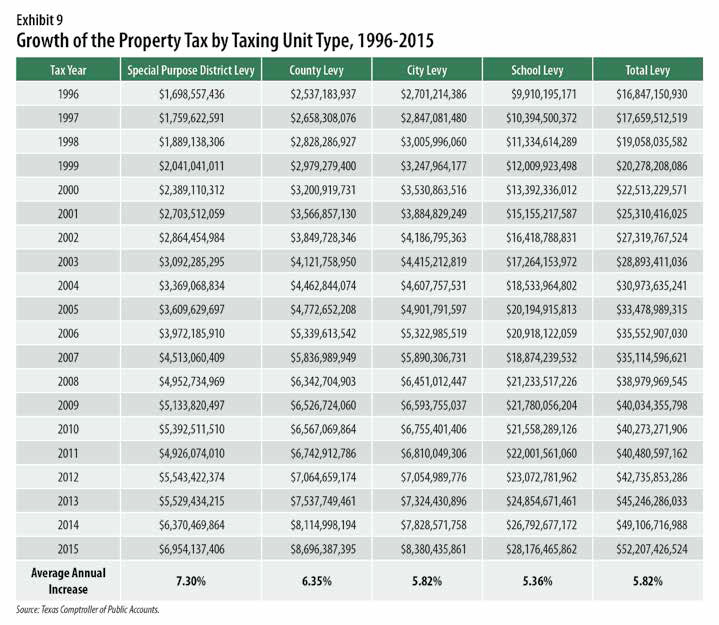

For information about levy growth for cities, counties, school districts and special purpose districts, see Exhibit 9.

Conclusion

Property tax is the largest tax imposed in Texas. In 2015, property tax generated more than $52 billion for all taxing units that can levy a property tax, and it represented almost 48 percent of all taxes imposed by state government and local taxing units.

Taxpayers can petition for a rollback election in cities, counties and other taxing units. Rollback elections are automatic for school districts. In 2014, rollback elections were held in 29 school districts compared to 41 in 2015. In 2014, voters rejected five school districts’ adopted tax. In 2015, voters rejected three school districts’ adopted tax.

The total market value of property and its taxable value increased in 2014 and 2015.